3rd Party Delivery Apps: Who Pays Sales Tax?

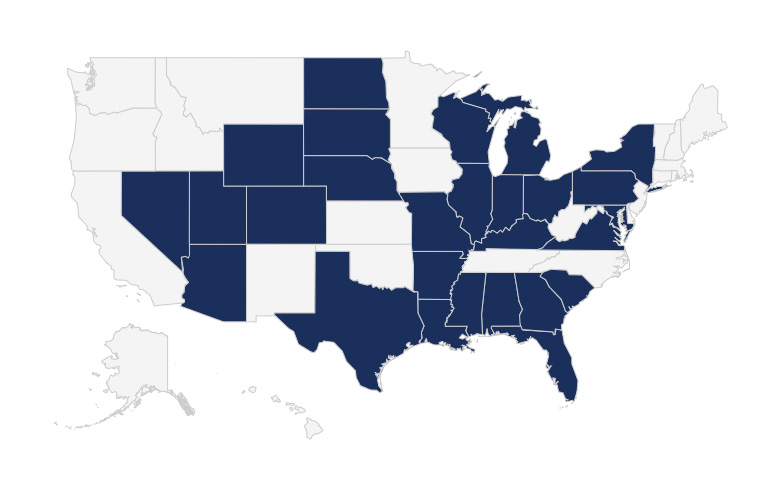

Sales tax liability on 3rd party food delivery apps is an important detail to make sure you have set-up correctly in your POS. Many states have changed or enacted laws around who is responsible for collecting and paying sales tax. You could be double-paying sales tax on these orders and not even know it.

Read more